Our vision is to be a model of appraisal and assessment administration with a reputation for delivering uniform, objective, and accurate assessments that meet statutory requirements and guidelines. We will satisfy our taxpayers/customers with courteous, timely and professional service at all times.

Mission StatementOur mission is to administer the Borough of Glen Ridge's Municipal Assessor's Office in a manner that assures public confidence in our accuracy, unbiased and objectivity in providing fair and equitable valuations of all real property. The State of New Jersey Constitution, Statutes, Administrative Code and the Uniform Standards of Professional Appraisal Practices will guide our mission.

Within the framework of N.J.S.A. 54:3-16, 54:4-23 & 54:4-26, the Municipal Assessor operates under the guidance of the Director of the Division of Taxation and the County Board of Taxation. Accordingly, the governing body has no right whatsoever to influence the Municipal Assessor as to valuation and assessment method since the responsibilities of the Municipal Assessor are independent of Municipal Government control.

Goals & ObjectivesThere are no substitutes for fair and equitable assessments!

Property Tax Relief ProgramsThe State of New Jersey offers several programs for property tax relief. You may be eligible for one or more of these:

Each of the above listed benefits have specific eligibility requirements and filing deadlines. Contact the Municipal Assessor's office at (973) 748-8400 x249 to find out if you qualify or for assistance in filling out the applications.

Chapter 75 PostcardsPostcards are mailed to property owners the end of January. This statutory requirement is intended to inform property owners of their assessment for the current tax year. If a property owner does not agree with their assessment, they may confer with the Municipal Assessor, or file an appeal. The appeal deadline is April 1st. Anyone wishing to appeal their assessment may obtain an appeal form from the Essex County Board of Taxation, 50 South Clinton Street, East Orange, NJ 07018. Their phone number is: (973) 395-8525

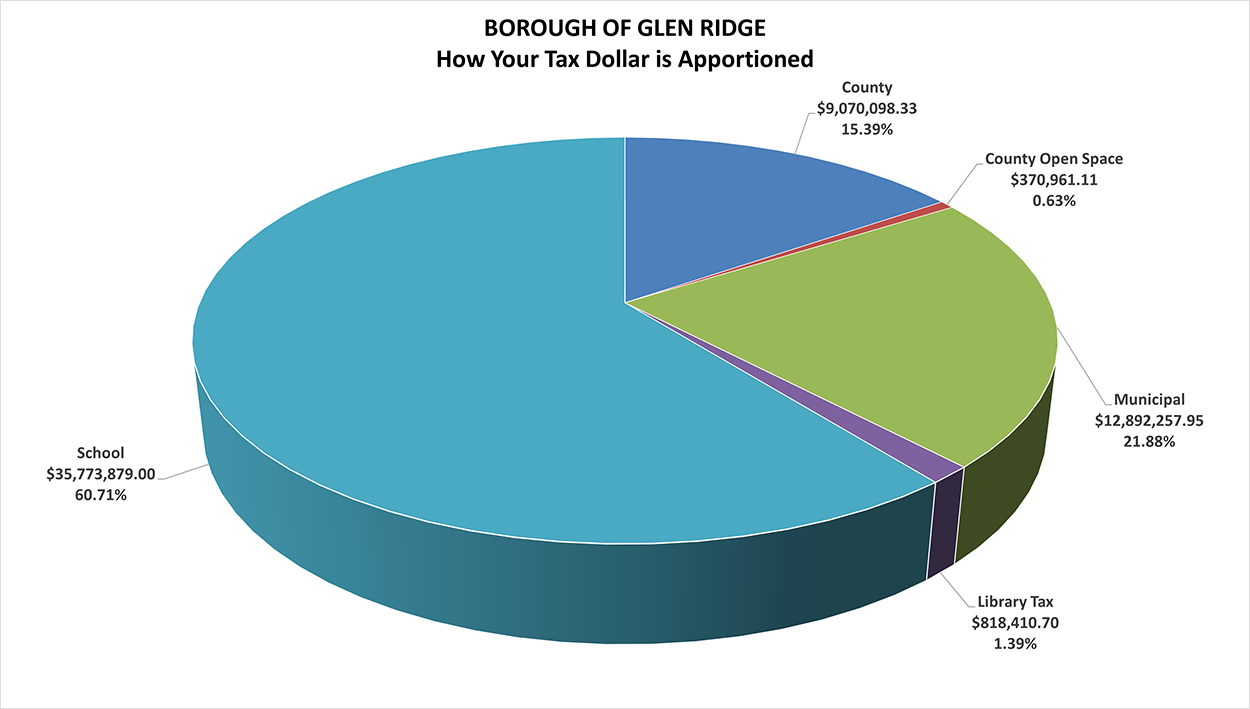

Borough of Glen Ridge Tax Rate & Levy Analysis|

|

|

% Change | % Change | ||||

|

|

|

|

|

Levy |

Rate |

Total |

|

| County | $9,391,907.73 | $0.546 |

$9,070,098.33 |

$0.526 |

(-3.43)% | (-3.65)% | 15.39% |

| County Open Space | $343,084.09 | $0.020 | $370,961.11 | $0.022 | 8.13% | 7.87% | 0.63% |

| Municipal | $12,478,359.11 | $0.726 | $12,892,257.95 | $0.748 | 3.32% | 3.07% | 21.88% |

| Library Tax | $754,685.67 | $0.044 | $818,410.70 | $0.047 | 8.44% | 8.19% | 1.39% |

| School | $35,058,925.00 | $2.038 | $35,773,879.00 | $2.075 | 2.04% | 1.80% | 60.71% |

| Total | $58,026,961.60 | $3.374 | $58,925,607.09 | $3.418 | 1.55% | 1.33% | 100.00% |

| Total Net Taxable Value 2023 | Total Net Taxable Value 2024 |

$ Change NTV |

% Change NTV |

| $1,720,115,800 | $1,724,169,000 | $4,053,200 | 0.24% |

| 2023 Equalized Value | 2024 Equalized Value |

$ Change |

% Change |

| $2,267,870,730 | $2,462,678,293 | $194,807,563 | 8.59% |

| 2023 Avg. Residential Assessment | 2024 Avg. Residential Assessment |

$ Change |

% Change |

| $670,100 | $672,500 | $2400 | 0.36% |